Philipsburg: The St. Maarten Chamber of Commerce and Industry (COCI) has taken note of the intention of the Central Bank of Curacao and Sint Maarten (CBCS), on the introduction of the Caribbean Guilder. The decision to introduce a Caribbean guilder in replacement of the Antillean Guilder is said to be based on the notion that this new guilder can help foster economic stability and prosperity within the monetary union”. This statement was made in the press release after CBCS made presentation to the Social Economic Council of Curacao.

The current guilder in no shape or form has led to economic instability or a lack of prosperity. This guilder has been pegged to the US dollar for years and its stability follows directly from the fact that the conversion of this guilder has remained consistent 1:1.8. The CBCS does not elaborate on the economic stability to be attained, which gives COCI cause to question the argument to introduce a new guilder. The Caribbean guilder will not be any different to the Antillean guilder, beyond a new look as a different value is not expected.

The cost related to the introduction of a new guilder is also one aspect that forces to question the need for a new currency now and how that expense made will enhance stability and propel prosperity. The need for a new currency has not been established, and in addition the cost for the introduction and the impact on the business sector and citizens, is a reason to question the timing. The current state of the economies within the monetary union does not support the burdening with additional and unnecessary costs related to the manufacturing and introduction of a new guilder bill.

COCI differs on the trajectory of economic stimulation as perceived by CBCS, in that there will be no impact with this introduction. This view is on the fact that the currency will have the same value or exchange rate, thereby not having the elements to strengthen the economies. Furthermore, looking at our domestic situation of St. Maarten for which by de-facto is already dollarized, and added with the fact the currency is not even accepted in the northern part of the island, it would just be more of the same.

CBCS as the financial regulatory body of the union’s financial sector, taking an initiative for the benefit of the union is always welcome. However, with the economies still faced with the negative impact of the passage of Hurricane Irma in 2017 and the Covid-19 pandemic of 2020, COCI is of the opinion that initiatives geared at stimulating the economies of the Union through the use monetary policies instruments would have been more ideal at this time, than just a change in the currency.

COCI therefore implores that CBCS, through the countries respective representatives’, formulates measures that can be triggered through monetary policies for the true benefits of the union. Policies geared at reducing inflation rates, stimulating business establishment and growth facilitating the ease of banking processes and other measures pertinent to stimulating the real sector of the economy are needed.

Even facilitating the ease of opening bank accounts, where possible is another initiative direly needed, since both economies (Curacao and St. Maarten) currently experience adverse effects due to the inefficiency in this process. A new dollar bill will on its own not impact the economy in the manner envisioned by the CBCS. as without the measures named nothing will change in the dynamics of things.

Latest News

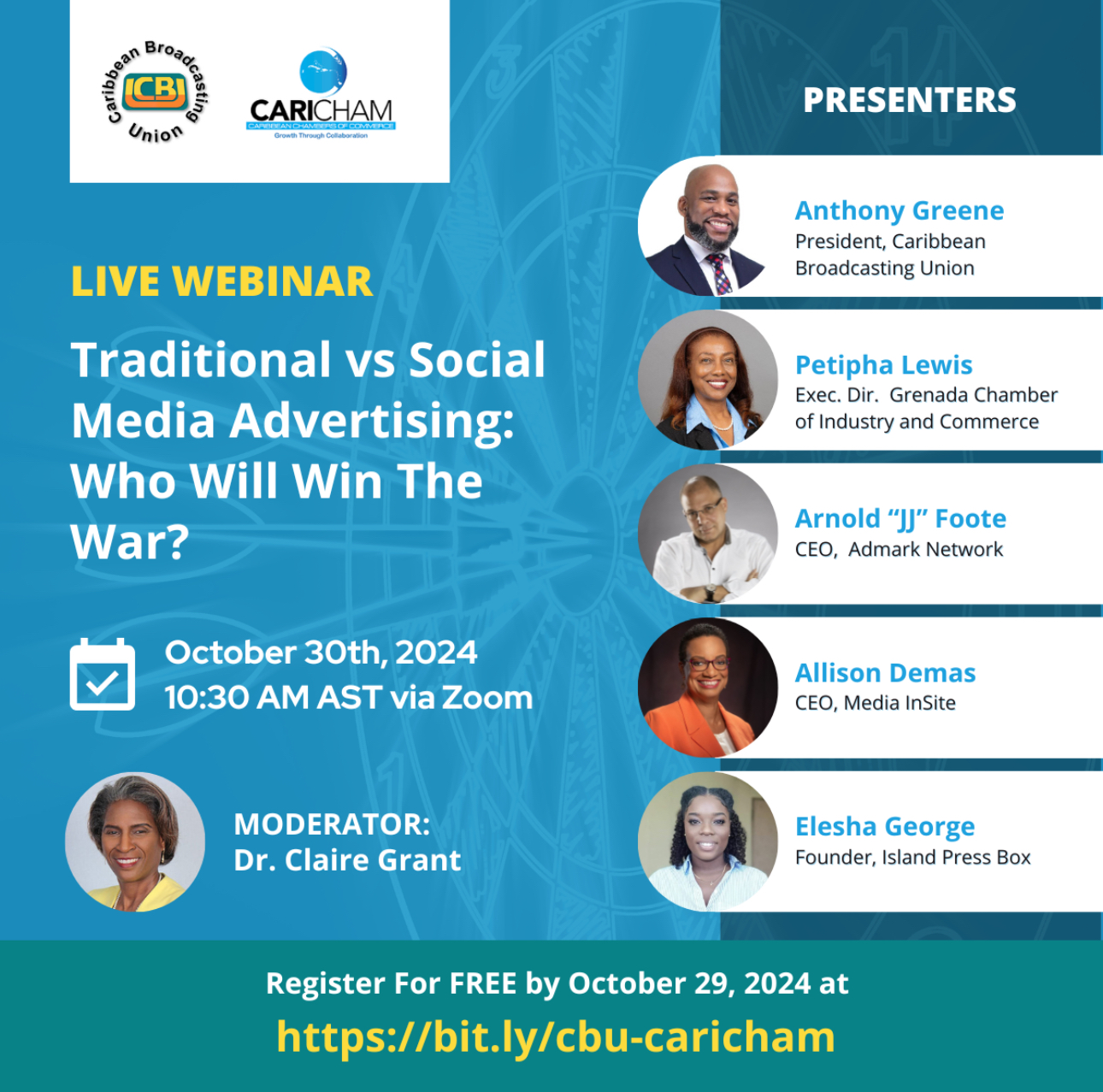

- LIVE WEBINAR: Traditional vs Social Media Advertising 22th Oct 2024

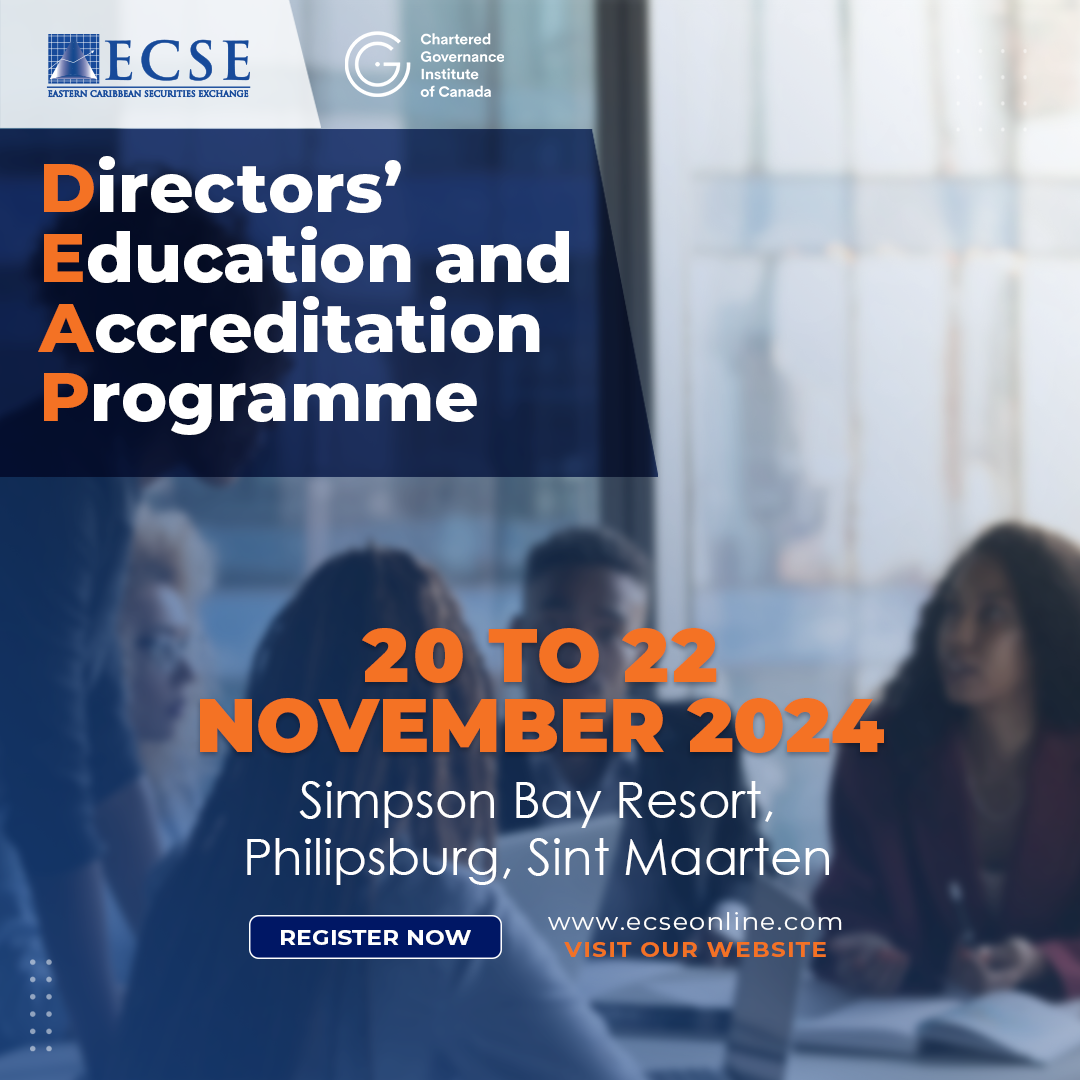

- Directors’ Education and Accreditation Programme 18th Oct 2024

- Online Payment Processing Timeline 05th Jul 2024

Upcoming Events